Editorial: Liberals incoherent on capital gains tax

Article content

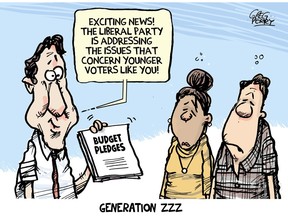

There’s no logic to Prime Minister Justin Trudeau’s claim that his budget’s tax hike represents “generational fairness.” This is his defence of the policy after scores of interest groups, including the Canadian Medical Association, have panned the changes.

Redistribution is only meaningful if the people paying less can be shown to derive a benefit from those paying more. Yet the Trudeau government has only shown the change will bring in marginally more revenue. What exactly this money will do – and for whom – is not known.

In fact, the Liberals can’t seem to decide their official reason for this tax hike. At times, they say they are merely “asking” the wealthiest to pay a little more of their fair share. At others, they say it’s about preventing today’s deficits from being passed on to future generations in the form of greater debt.

Other times still, they say it’s about the unfairness of younger people struggling to afford housing, whilst older people are able to earn untaxed capital gains. More specifically, they seem to imply that the higher capital taxes will in some way support interventions to address stagnant housing supply.

None of these points is very convincing. Raising taxes will involve some people paying more, yes, but who’s to say what a fair amount is, or who should be penalized to achieve fairness? Likewise, avoiding new debt is great – except the Liberals aren’t doing this. Even with their tax hike, they’re still going into deficit to pay for their programs.

“Housing fairness” is even more puzzling. People, no matter how rich they are, don’t pay capital gains on their primary residence, so why would raising the rate have anything to do with the injustices of affordable housing?

And on housing programs, the Liberals aren’t proposing to actually build more homes. Rather, they want to cut deals with municipalities to increase density – in effect, bribing cities and towns to do what they should be doing anyway.

None of this forms a solid argument for why, in a moment of basement-level capital investment, we should be taxing capital even more. This is bad public policy.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.